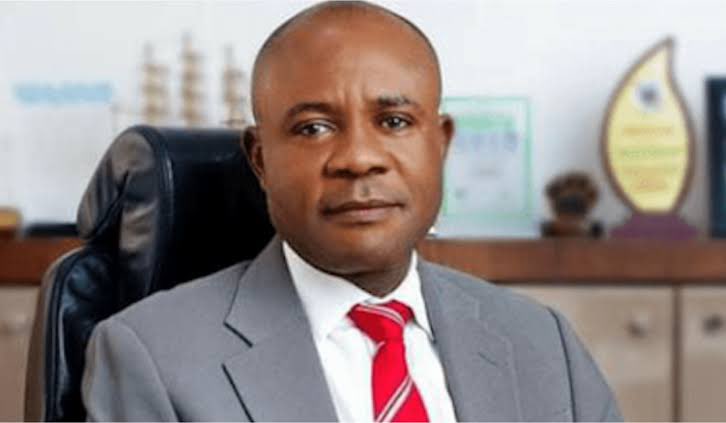

Gov Mbah to Unveil over $2.1bn Project Pipeline, as Enugu Holds Inaugural Investment Roundtable

Governor of Enugu State, Dr. Peter Mbah, will on Friday, Friday, September 1, unveil a ₦1.6 trillion ($2.1 billion) pipeline of 30 projects at the first Enugu State Investment and Economic Growth Stakeholder Roundtable.

The governor is also scheduled to launch the Enugu State Integrated Sector-Based Productivity Growth Strategy.

This was made known in a statement released by the Secretary of the State Government (SSG), Prof. Chidiebere Onyia, in Enugu on Monday.

He said the Investment and Economic Growth Roundtable, which is a precursor to the launch of the maiden multi-stakeholder and fully transactional Diaspora and Investment Forum scheduled for the second quarter of 2024, would hold in Enugu and also draw investors from across various industries locally and internationally.

“The ₦1.6 trillion Naira ($2.1 billion) project pipeline spans several industries, including transportation and healthcare infrastructure, as well as energy, power, and agro-allied industrialization.

Read Also: BBNaija AllStars: Doyin Emerges As Head Of House For Week 6

“Senior executives from the World Bank Group, the African Development Bank Group, the International Finance Corporation, the African Export-Import Bank, the United Kingdom Department for Trade and Business, the Africa Finance Corporation (AFC), as well as the Nigerian Sovereign Wealth Fund, commercial banks, corporate pension funds, private equity funds, infrastructure funds, and other domestic financial institutions will convene in Enugu to chart a course for effectively mobilising private capital for large-scale infrastructure projects, including net-zero aligned projects that can unlock Enugu State’s and South-Eastern Nigeria’s economic potential.

“The Roundtable discussion will cover a range of topics, including addressing barriers to investment and economic growth in Enugu State; improving investor confidence in the State understanding investor’s risk and return preferences; and identifying partnership opportunities for project preparation and co‑investments” he stated.